QLCredit is a term that appears across two very different domains: digital finance and higher education. Because of this dual usage, many people feel confused when they encounter it online. Some see it linked to lending platforms and financial services, while others encounter it in academic catalogs or university degree requirements.

This article brings everything together in one clear, structured guide. It explains all major meanings of QLCredit, how each context works, what matters most to users, and how to interpret the term safely and correctly. Nothing essential is left out.

What Does QLCredit Mean?

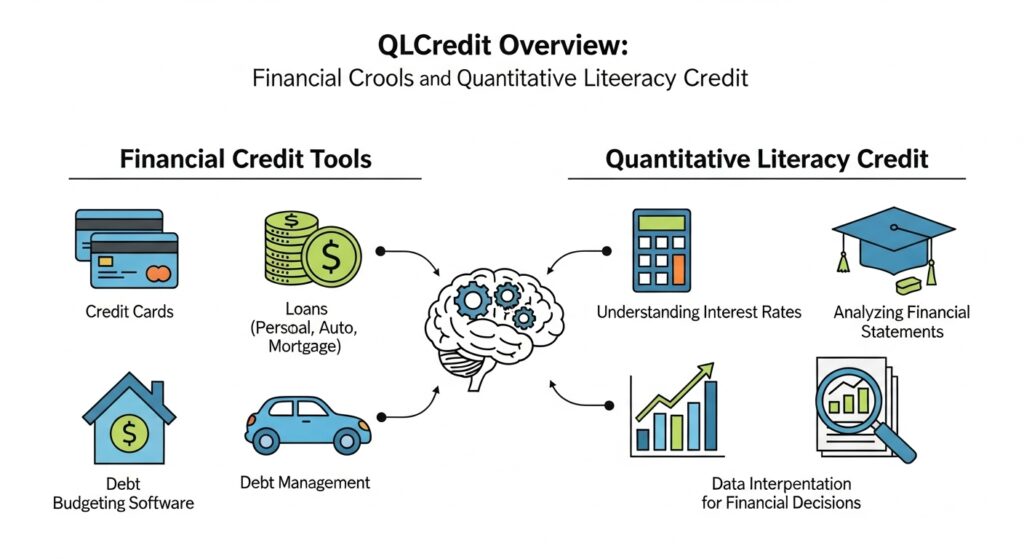

QLCredit is not a single universal product or institution. Instead, it is a context-dependent term with two primary meanings:

- A digital finance or lending-related label, used by online credit platforms, financial services, or brand names

- An academic abbreviation for Quantitative Literacy credit, used by colleges and universities

Understanding which meaning applies depends entirely on where and how you encountered the term.

QLCredit in Financial and Digital Lending Contexts

QLCredit as a Digital Credit or Lending Platform

In the financial space, QLCredit most commonly refers to digital credit services designed to simplify borrowing. These platforms aim to remove traditional banking friction by offering online applications, faster approvals, and flexible repayment structures.

Instead of relying only on conventional credit scores, many QLCredit-style platforms evaluate applicants using alternative data, such as income patterns, transaction history, or business cash flow. As a result, they often appeal to freelancers, small business owners, gig workers, and individuals with limited credit history.

Common Financial Services Associated With QLCredit

Although features vary by provider, QLCredit-related financial platforms usually offer:

- Short-term personal or business loans

- Online credit applications with minimal paperwork

- Fast approval decisions

- Transparent digital dashboards for repayment tracking

- Credit education or guidance tools

These services are designed to be mobile-first, user-friendly, and accessible.

QL Credit Gain Finance and Licensed Lending Operations

In some regions, QLCredit is also associated with licensed money lenders operating under regulated frameworks. One example often referenced in competitor discussions is QL Credit Gain Finance, a Hong Kong–based licensed money lender established in 2014.

Such entities typically provide:

- Private loans

- Business financing

- Property-backed lending

- Regulated lending services under local financial authorities

In these cases, QLCredit functions as a brand or platform name, not a generic loan type. This distinction matters because licensing, compliance, and consumer protections depend on the specific operator behind the name.

Historical Use: QLCredit and Financial Health Platforms

Historically, the term has also been used in connection with financial wellness tools developed within broader corporate ecosystems. Some early uses appeared in startups focused on helping users gain a clearer picture of their financial health, budgeting behavior, and credit readiness.

In this context, QLCredit referred less to borrowing and more to financial insight, education, and preparedness.

How Digital QLCredit Platforms Typically Work

While each provider differs, most digital credit platforms using this label follow a similar structure.

Step 1: Digital Onboarding

Users create an account using basic personal details. Identity verification may be required, depending on regulation.

Step 2: Financial Assessment

Instead of relying only on credit bureau scores, platforms may analyze income consistency, spending habits, or business transactions.

Step 3: Credit Offer Presentation

Approved users receive loan or credit offers with clearly displayed amounts, repayment schedules, and costs.

Step 4: Disbursement and Repayment

Funds are transferred digitally, and repayments are managed through a centralized dashboard.

This process prioritizes speed, clarity, and accessibility, although users must still review terms carefully.

Benefits of QLCredit-Style Financial Platforms

When operated transparently and responsibly, these platforms can offer meaningful advantages.

- Faster access to credit compared to traditional banks

- Broader inclusion for underbanked individuals

- Digital convenience with full visibility of repayment terms

- Educational tools that support better financial habits

However, these benefits depend entirely on the specific provider’s practices and transparency.

Risks and Considerations in the Financial Context

Because QLCredit is not a single regulated global brand, caution is essential.

Key Risks to Watch For

- Unclear ownership or missing legal disclosures

- High interest rates tied to short repayment cycles

- Excessive data or device permission requests

- Pressure-driven approval messaging

Therefore, users should always verify the company identity, licensing status, and full cost of credit before proceeding.

QLCredit in Education: Quantitative Literacy Credit

What Is Quantitative Literacy Credit?

In academic settings, QLCredit stands for Quantitative Literacy credit, often abbreviated as QL credit. It represents a curriculum requirement designed to ensure students develop essential numerical and analytical skills.

These credits focus on real-world mathematical reasoning, not advanced theoretical math.

Purpose of Quantitative Literacy Requirements

Universities use QL credit requirements to help students:

- Interpret data and statistics

- Apply mathematical reasoning to everyday decisions

- Analyze information critically across disciplines

- Build confidence with numbers in professional contexts

These skills support long-term academic and career success, regardless of major.

How Students Earn QLCredit in Universities

Students typically earn QL credit through one of the following paths:

- Completing approved math or statistics courses

- Passing designated quantitative reasoning classes

- Achieving qualifying scores on standardized exams such as SAT or ACT

- Transferring equivalent coursework from another institution

The exact criteria vary by institution, but the goal remains consistent: practical numerical competence.

Universities That Commonly Use QLCredit Requirements

Many higher education systems, including liberal arts colleges and state universities, integrate QL credit into general education frameworks. These requirements apply across disciplines, from humanities to sciences, ensuring balanced academic development.

Key Differences Between Financial and Academic QLCredit

| Aspect | Financial Context | Academic Context |

|---|---|---|

| Purpose | Credit access and financial tools | Math and analytical competency |

| Users | Borrowers, individuals, businesses | University students |

| Regulation | Financial authorities | Academic institutions |

| Outcome | Loans, repayment, financial access | Degree progression |

Understanding this distinction prevents confusion and misinterpretation.

How to Identify Which QLCredit Meaning Applies to You

Ask yourself these questions:

- Did you see QLCredit in a loan app, ad, or finance website?

- Did you encounter it in a university course catalog or degree audit?

The source usually makes the meaning clear. When in doubt, check the surrounding context carefully.

Practical Guidance for Financial Users

If you are exploring a QLCredit-related financial service:

- Confirm the legal company name and license

- Read all repayment terms carefully

- Avoid borrowing beyond your repayment capacity

- Use credit as a tool, not a long-term solution

Responsible usage matters more than speed.

Practical Guidance for Students

If QLCredit appears in your academic plan:

- Confirm which courses satisfy the requirement

- Ask advisors about alternatives or test-based exemptions

- Complete the requirement early to avoid graduation delays

Quantitative literacy supports many career paths, even outside math-heavy fields.

Final Conclusion

QLCredit is a multi-context term, not a one-size-fits-all concept. In finance, it often points to digital credit platforms or lending services that emphasize accessibility and speed. In education, it represents a foundational requirement designed to build essential quantitative skills.

Understanding the context is the key to using the term correctly. When you do, QLCredit becomes straightforward rather than confusing.

Whether you are evaluating a financial platform or planning your academic path, clarity, verification, and informed decision-making always come first.

Frequently Asked Questions (FAQ’s)

Is QLCredit a bank or official institution?

No. It is a term used in different contexts, not a single global institution.

Can QLCredit refer to both finance and education?

Yes. The meaning depends entirely on where it appears.

Does QLCredit guarantee loan approval?

No legitimate credit service guarantees approval. Decisions depend on eligibility and provider criteria.

Is Quantitative Literacy credit difficult?

Most QL courses focus on practical understanding, not advanced mathematics.